Buying Our First Home as a Gay Couple | First Time Home-Owners and What to Expect

Starting the long process of packing everything up… the adventure begins!

Buying a home can be a daunting task. It’s the average human’s largest purchase they will make in their life and there are a lot of unknowns; especially when it’s your first time going through the process. We wanted to share our home buying experience to outline what we experienced and help you know what to expect.

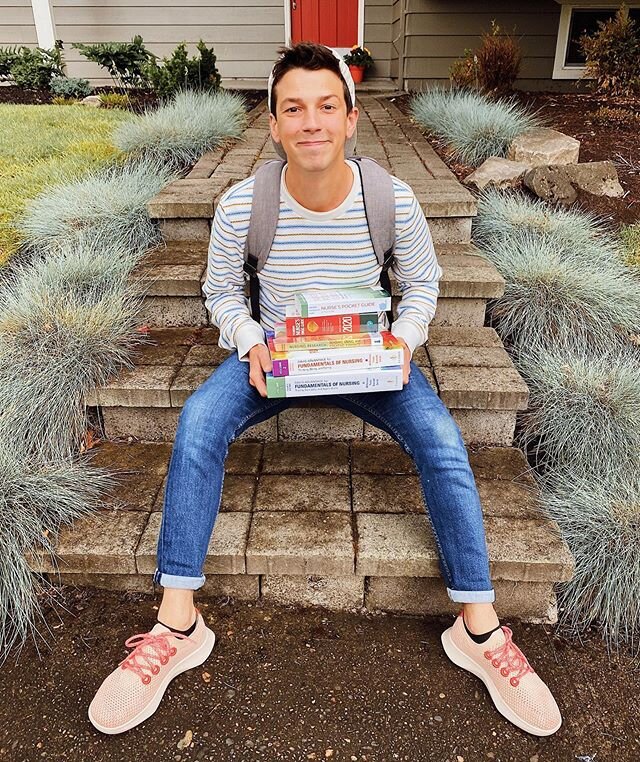

When we moved to Oregon, we set a goal: To be done renting in two years. It was a number we had discussed with financial advisors regarding home purchase vs. renting when coming out of school. They explained two to three years as a sweet spot to rent and build up some savings for a down payment. If you felt ready in two to three years, start looking! We found an amazing rental house when we first moved and were very comfortable with two years in the space as we saved for our down payment and got a few years of work under our belts.

Sharing our first meal in the new house immediately after getting the keys.

We knew we would not be able to put 20% down but somewhere between 5%-10% we were told was acceptable for most first time homebuyers, especially in the market we were in. Done. We had a goal. Somewhere late spring/early summer of 2020 we would be in a home.

And honestly, things went pretty well to plan. We didn’t expect to start seriously looking until closer to March but a house came up online the December prior that we both were very interested in. The only problem was we had no idea who could show us the house or, if we liked it, how to put in an offer. Thus, late December 2019 we decided to get our ducks in a row.

The first two steps we learned were 1) find a realtor, and 2) find a loan servicer. We relied solely on recommendations from family and friends for this process. We initially met with a realtor we connected with through Zillow just by clicking the “I’m interested” button. This connects whichever agent is associated with that house to you. We met in person to go over the process. It was a nice overview of the home buying experience but we didn’t leave feeling inspired to work with her. We asked around and got a recommendation from our neighbors who said they LOVED their realtor. We met her in person and could tell she knew her stuff. She talked fast and had concise answers to all of our questions. Step 1, done!

The second step was getting pre-approved. This is a more tedious yet exciting part of the journey as you get a feel for what you can afford. For this part we went with the same loan provider Michael’s sister used in Arizona. He was licensed in Oregon and they had a great experience with him. We felt comfortable with him from day one and he was always honest and thorough with us, making sure we didn’t end up “house-poor.” Step 2, check!

Pre-approval letter in hand, we could start seriously looking and figuring out what we wanted and where we wanted to be. This is maybe the most confusing part.

When you live in a city that has a decent breadth of metropolitan area, there are many acceptable places to live with pros and cons. I (Michael) LOVE being close to work as Portland traffic is nothing if not unpredictable and can be very slow during rush hour. Matthew loves the idea of being in the center of it all, but he also wanted a yard, garage, privacy, and a nice safe neighborhood. Ultimately, you compromise somewhere. Our compromise ended up being in a more suburban area with easy access to the highway to get downtown. For this, we got a quiet established neighborhood, garage, a nice outdoor space and were able to maintain an easy commute for both. It’s not hip or trendy and there are not bars and restaurants around every corner, but it works great for what our lives will look like in the coming years.

This brings us to the purchase! So many things to know when everything starts coming together.

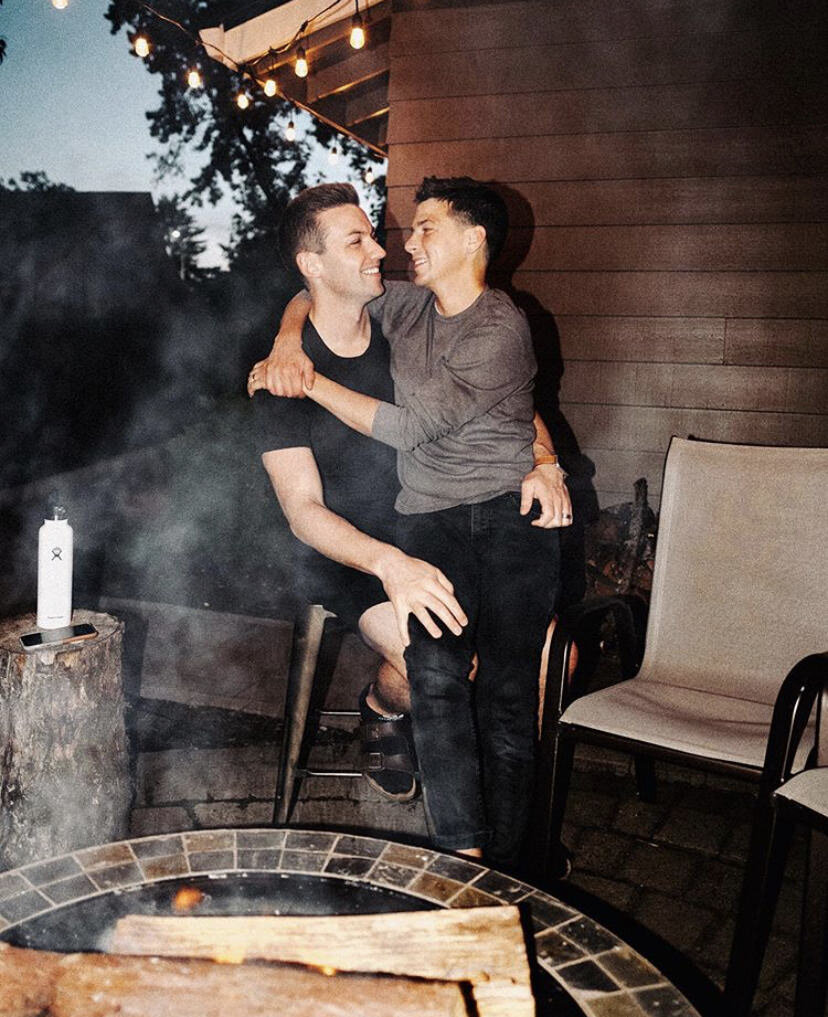

Smiling after a long day of getting things moved in and unpacked.

First - your offer is accepted! WOW! YAY! Wait, are we sure?!? What if something is wrong with the house? Does everything work? What if something is broken? If you have a good realtor they will have told you there is still time to walk away without losing anything. However, you have to decide pretty quickly as out-of-pocket expenses come up soon after offer acceptance. You will need to pay for 1) a Home inspection: $500-700 2) a Sewer scope: $100-200 and 3) an Appraisal: $300-$600. You will also need to write a check for your earnest money prior to closing

Deciding on what to offer is totally dependent on market competition, cost of living, urban/rural, etc. Ultimately you will work with your realtor to decide if a house is priced over or under market, and what you may need to offer if it’s the house you really want.

Second, you will, or should, get a chance to walk through the house again after your offer is accepted and really take it all in. Is it what you want? Where you want? Are there projects you need to be saving for? Do you have the right equipment for the lawn, garden, etc? Do you have tools? Do you need to buy tools? The list honestly goes on and on and on. We have definitely learned that you can make your house a full-time job if you want, even move-in-ready homes you will find something to do! If you still feel good about the purchase then let the festivities begin!

Next, you will go through the reports from inspection, scope, and appraisal. The inspection is by far the highest priority of the three; unless there is something wildly wrong with your sewer line, if that’s the case strongly reconsider the home! The home inspection is a rather lengthy document nicely put together to check the foundation, roof, electrical setup, outside safety, mold, radon, fireplaces, plumbing, etc. It is not a complete endorsement that everything in the home is perfect and there are many things listed that will need or be recommended to fix. It is an overwhelming document and definitely gives you an idea of how many things could be wrong or need repairs. A good inspector will let you know which areas to focus on and those that are less important.

The inspection is where you as a buyer can start asking for “seller concessions.” You can ask for the seller to fix everything, but it is unlikely that they will agree as there are only so many days until closing and handing over of keys for those asks to be completed. If there is a solid list of repairs needed, instead of trying to get the sellers to fix them in the 30 days before closing, you can ask for a credit towards your downpayment. Our home specifically had a plumbing issue that we asked the sellers to repair prior to closing as it could have revealed damage to the home, everything else we prorated into our concessions.

During inspections we found so many different things we wanted to change about the new place. The biggest thing on our list — remodel the upstairs bathroom.

After inspections, concessions, negotiations, etc. you move on toward closing. Closing on a house is exciting and boring at the same time. You go through 70-100 pages of documents and sign around 20-30 of them (I clearly lost track, it was a lot), you pay your downpayment and leave as the new owners! Unsure if under normal circumstances you also get the keys at this time but in our case we met our realtor at the house later to get the keys due to coronavirus restrictions not allowing her to be at closing.

Meeting the realtor at our new home was a feeling of accomplishment and anxiety. We have been dreaming of owning our first home for what seems like such a long time. Planning, saving, touring, offering, and now - owning. It was the biggest purchase either of us had either made and subsequently the most responsibility either of us had ever taken on. It was comforting and overwhelming all at the same time. Walking through the now empty vessel, thinking of those who have made it their home before you and trying to envision what you want to make it in the future.

It took a few days but once we had things arranged and organized, the house started looking more and more like our home. We stopped feeling like imposters and started making plans, planting flowers, adding to the garden, and quickly turned the space into somewhere we felt at home.

Even though our home was considered “move-in ready,” there are still so many things we want to do to add our own touch to. We painted an accent wall, hung tons of photos and wall decor, spent a small fortune on a nice lamp and chandelier for the living space, garnered eight additional house plants, bought new deck furniture, and more. Michael still wants to sheetrock and finish the garage, we want to add even more garden space to grow our own produce in the summer, get new furniture for our living space, recarpet the downstairs, and the BIG project of gutting and remodeling the entire upstairs bathroom. There is honestly more but we’ll start with those for now.

If you’re planning a trip—or already lucky enough to call Seattle home—this guide is for you. Here, I’m sharing some outstanding LGBTQ+-owned businesses, the top places to eat in Seattle, the best bars to visit in Seattle, and a variety of iconic (and lesser-known) attractions that Michael and I just can’t resist.